Last month, we laid down the ground rules of smart borrowing. Don’t just take on debt—align it with your strategy and goals. Protect your cash flow. Avoid the traps that sink your business.

Now it’s time for your next step: deciding wisely.

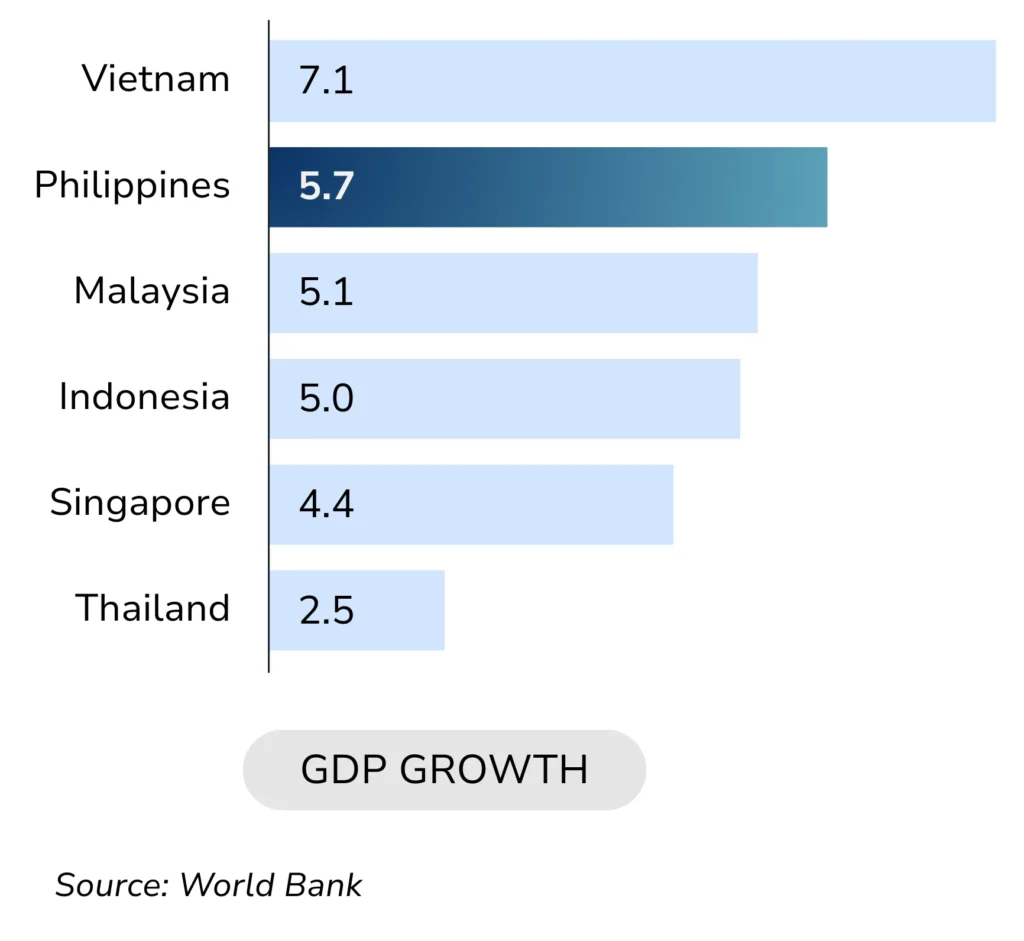

Because growth isn’t a gamble. It’s a strategy. And the best strategies start with reading the signals—GDP, population and employment trends, inflation rates, and tariffs. These numbers aren’t just stats; they’re roadmaps. They show us when to expand, when to steady, and how to pace for long-term sustainability.

As Q4 approaches, let’s position your business not just for survival, but for sustainable success.

For years, the Philippines has carried the label of “a nation of potential.” But here’s the hard truth: potential is not destiny. Betting on tomorrow without preparing today has never been a winning strategy.

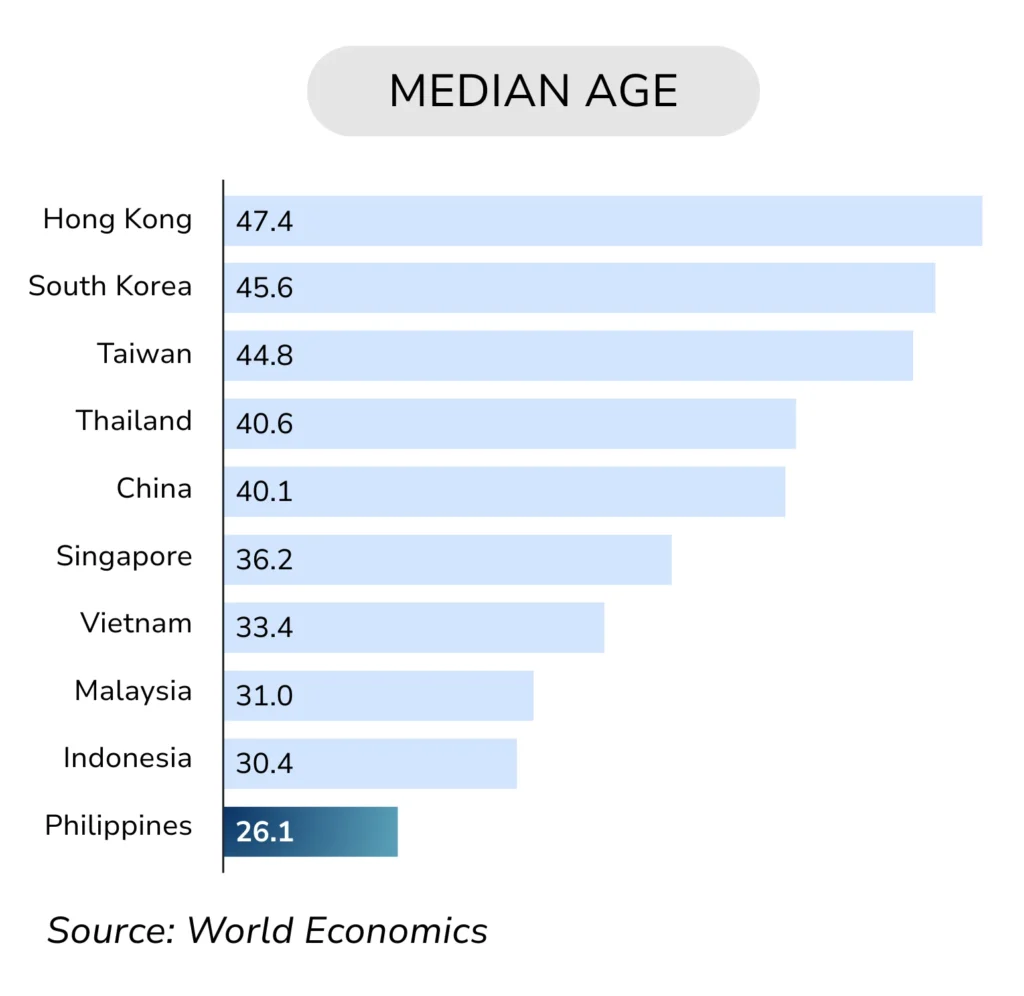

Sure, the fundamentals are there:

That’s a powerful base. But none of these matter unless we act with foresight and decisive choices.

And no one sits more central to this story than MSMEs:

MSMEs are the economy’s engine. For SMEs in our space, the responsibility doesn’t rest on you alone—but the collective decisions you make today, together with the wider MSME community, will ripple across industries, communities, and the country’s sustainable future.

So what should SMEs watch in 2025? Let’s break it down.

Why They Matter for Your Business Decisions

The Philippines’ median age is 26.1, placing us among the youngest in Asia. Our people are young, dynamic, and ready.

Takeaway: A young labor force means an abundant workforce ready to take on opportunities across industries.

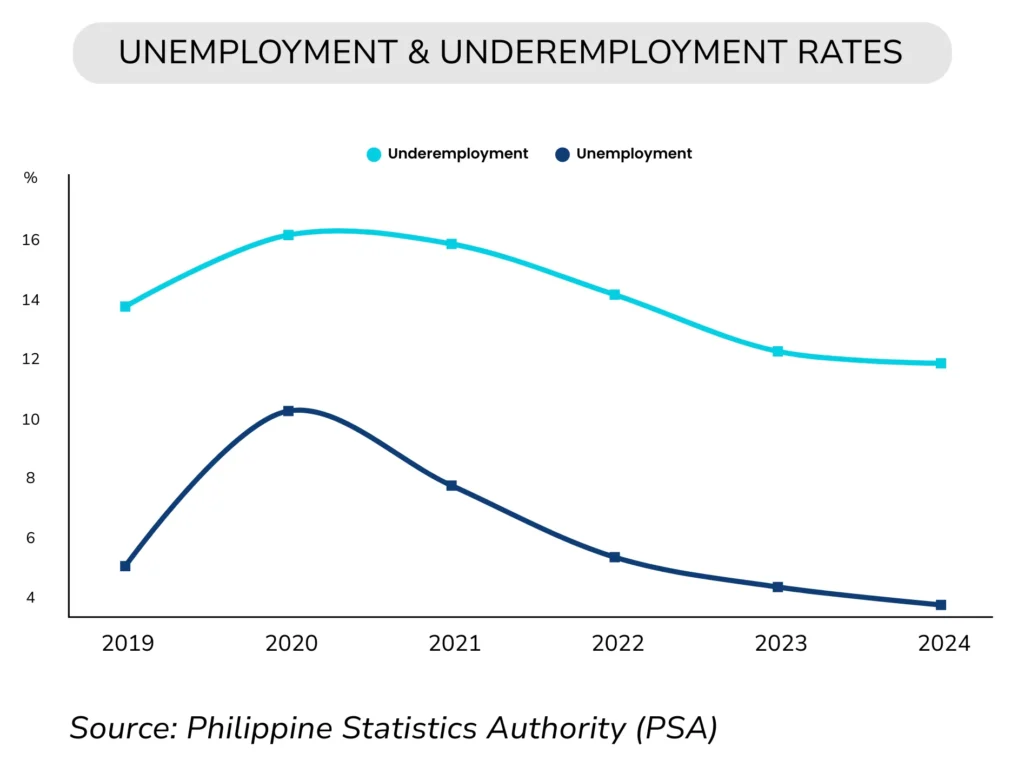

Since 2020, unemployment and underemployment have been on the decline, which means more Filipinos are earning and spending.

Layer onto that, a growing middle class. According to Boston Consulting Group, the number of middle-income and affluent households in the Philippines is projected to grow by 5% annually until 2030.

Takeaway: More Filipinos with disposable income=higher demand for goods and services.

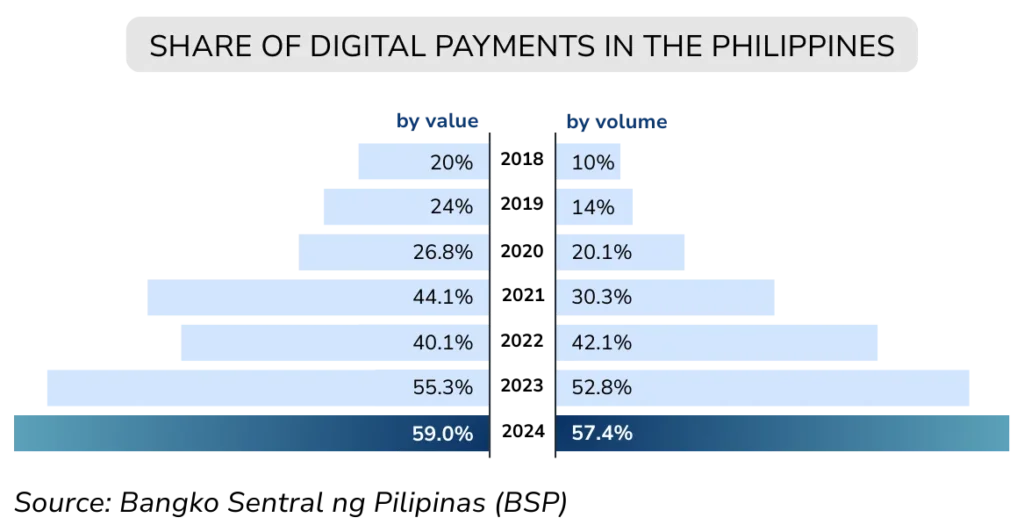

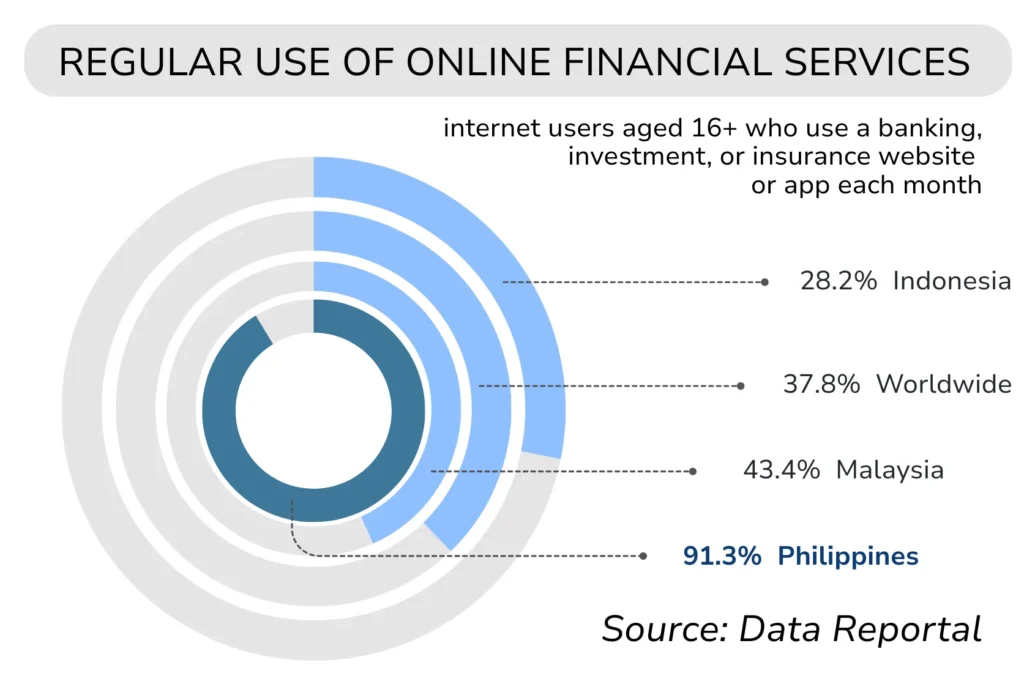

Look at how quickly digital payments and online financial services are becoming part of everyday life.

In 2024, over 91% of Filipino internet users accessed banking, insurance, or investment app each month—more than double the global average. Our nation isn’t just mobile-first. It’s fintech-ready.

Takeaway: For SMEs, you’ve got talent that’s globally competitive, you can get to position your business to compete for both local and international markets. With digital tools and finance now within reach, you can back your potential with real numbers and healthier cash flow.

What Stability Means for SMEs

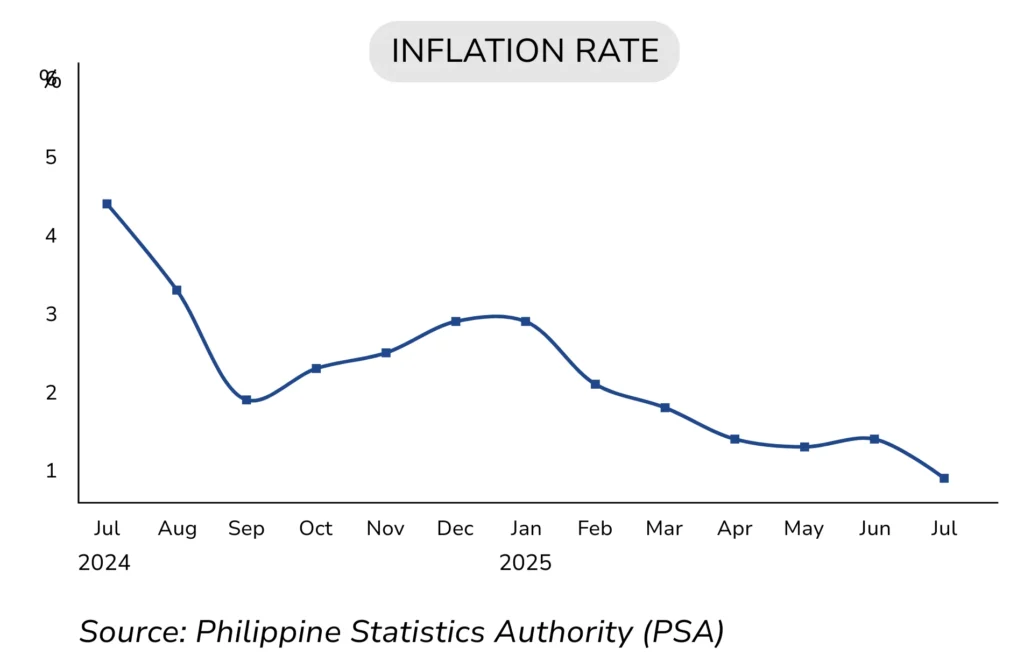

We’ve talked about talent and demand. But let’s get real: your margins live and die by costs. That’s where inflation comes in—and right now, the trend is on your side.

Takeaway: SMEs are seeing relief in raw material and operating costs. They may find more space to strengthen their workforce, refine their operations, and test new products—without cutting too deep into margins.

Takeaway: For SMEs, that means cheaper borrowing costs. If you’re planning to expand or refinance, the timing may work in your favor.

Takeaway: Demand is rising. Meet it with the quality products and services.

Takeaway: Predictable pricing isn’t just an operational win—it builds trust. Customers stick with brands that don’t keep them guessing.

Takeaway: SMEs can take bolder long-term steps—whether that’s expanding capacity, investing in tech, or exploring new markets.

Cheaper imports don’t just come from lower inflation—they’re also shaped by policy.

Effective August 2025, Philippine exports to the US now face a 19% tariff. Meanwhile, selected goods from the US are entering the Philippine market tariff-free.

Takeaway: Cheaper imports may benefit consumers, but they can squeeze local producers. If your business plays in price-sensitive sectors, you’ll need to compete smarter, not cheaper.

You’ve got a market that’s expanding both in talent supply and consumer demand. For SMEs, that’s a rare dual advantage: people to build with, and people to sell to.

Here’s how to make that momentum work for you:

Lock in cost advantages: With inflation easing, secure good supplier terms now while prices are stable. Use lower borrowing costs to upgrade systems, tech, or capacity that makes growth sustainable.

Build your team with intent: Talent is abundant—hire smart, train well, and keep people who can grow with your business.

Show up online: The market’s already digital. If your tools and presence aren’t, you’re invisible to half your customers.

Revisit your product-market fit: What worked five years ago may not land with today’s rising middle class. Adjust before you get left behind.

Play to consumer confidence: More Filipinos are ready to spend—position your products as reliable, trustworthy, and worth their peso.

Differentiate to survive competition: Imports may be cheaper, but service, quality, and local insight are advantages only SMEs can own.

Choose your long-term financing partner: From locking in costs to surviving competition, every move requires smart, well-timed financing.

At Mount Fuji, we make sure every peso borrowed moves you closer to sustainable growth. That’s why we take time to understand your business alongside market and economic signals, and tailor loans that serve you today and protect you tomorrow.

Ambition is everywhere. The real challenge is transforming that ambition into growth that lasts. Markets will shift, policies will change, and costs will rise and fall. But one truth remains: SMEs that prepare are the SMEs that prosper.

The signals are already in front of you. When you learn to read them—and act with foresight—you don’t just survive uncertainty. You turn it into your advantage.

At Mount Fuji Lending, we see you not just as borrowers but as builders of the future economy.

That’s why we bring clarity, context, and financing designed to protect and power your

tomorrow—so your bold decisions today are built to last.

📩 Let’s start that conversation.